For example you may have transferred your books to TallyERP 9 in the middle of the year and may not have closed them in your earlier system. Enter the email address you signed up with and well email you a reset link.

What Are Return Inwards Example Journal Entry Accounting Capital

Definition A trial balance is.

. Hence you must specify debit or. From the cash column on the debit side of the Cash Book. Credit or debit cards were not yet widely used.

Credit the decrease in asset Treatment of sales returns or return inwards in books of accounts Treatment of Sales Returns in the Financial Statements. Returned outward clearing cheques Personal Free. Accounting software like TallyPrime is designed to ensure that debit and credit always match at the time of recording the transaction itself.

Cheque photocopy less than 1 year. The NEFT clearing centre sorts fund transfer destination-wise and prepare to account entries to receive funds from the originating banks debit and give credit the funds to the designated bank. We debit this amount to Profit and Loss Ac.

If you get a loan to buy a car the bank credits your current account and you then write a cheque use a credit or debit card or initiate a bank transfer to the car dealer to buy the car. A credit note is sent to inform about the credit. All adjustments required to be done at the end of the period including closing stock are generally given under the trail balance.

Total of the Discount column on the debit side of the Cash book. This article is written by Shreya SK Pandey a student of Law College Dehradun Faculty of Uttaranchal UniversityIn this article she discusses the debit note credit note and the E-way bill features of debit and credit notes and how the registration of E-way bill is done under Goods and Services Tax GST and how to unregister person will enroll in E-way Bill System. The cost of goods sold in a manufacturing business includes direct material labor cost product cost allowances freight inwards and factory production overhead Factory Production Overhead Factory Overhead also called Factory Burden is the total of all the indirect expenses related to the production of goods such as Quality Assurance Salaries Factory Rent.

105 105 per instance. Special Clearing - Inward. Losses Depreciation Return inwards Profit and loss Ac Dr Bad debts etc.

Today a debit card works by instantly verifying the balance of your bank account and debiting from it. Thus matching of the trial balance is a Thing of Past and the traditional need for someone to depend on trial balance is eradicated. In the double entry system of book keeping there will be credit for every debit and there will not be any debit without credit.

Cheque photocopy over 1 year. You can enter balances for accounts that have obverse balances such as revenue accounts. For an existing companydebit balances for assets and credit balances for liabilities are applicable.

The entries about the Freight inwards are posted on the debit side of the trading account whereas the entries about the carriage outwards are posted on the credit side of an income statement Income Statement The income statement is one of the companys financial reports that summarizes all of the companys revenues and expenses over time in order to. Return inwards or sales returns are shown in the trading. When a Seller receives goods returned from the buyer he prepares and sends a credit note as an intimation to the buyer showing that the money for the related goods is being returned in the form of a credit note.

And after that bank-wise remittance messages are forwarded to the destination bank through their pooling centre NEFT Service Centre. From the bank column on the debit side of the Cash Book. The trail balance generally does not include stock in hand at the end of the period.

Debit the decrease in revenue To Debtors Account. And it will be shown on the credit side of profit and loss account. Sample Format of a Debit Note.

Related Topic Accounts Payable with Journal Entries Credit Note. In case if bad debts are recovered so it is again. In case if the provision is already made for bad bets than it is first written off from it.

Get the latest news and analysis in the stock market today including national and world stock market news business news financial news and more. This is money in a modern economy. Now it is not credited to the partys account but should be credited to bad debts recovered account.

Sales returns Return inwards Total sales returns from the Return Inwards Day book Sales returns journal. Journal Entry for Sales Returns or Return inwards in Credit Sales Returns Account. Cheque return - Inward Return Reason Represent after 3 working days for every item responded.

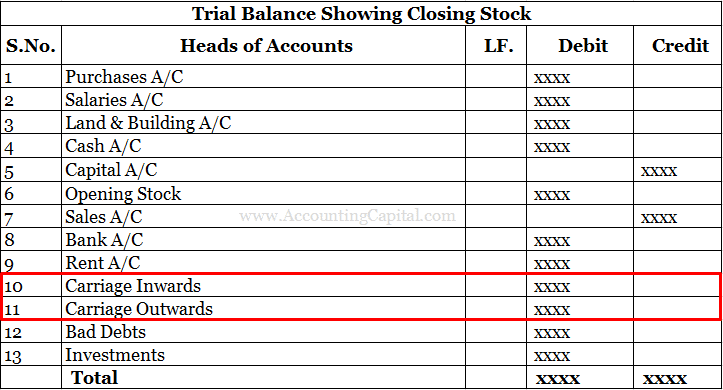

How Is Return Outwards Treated In Trial Balance Accounting Capital

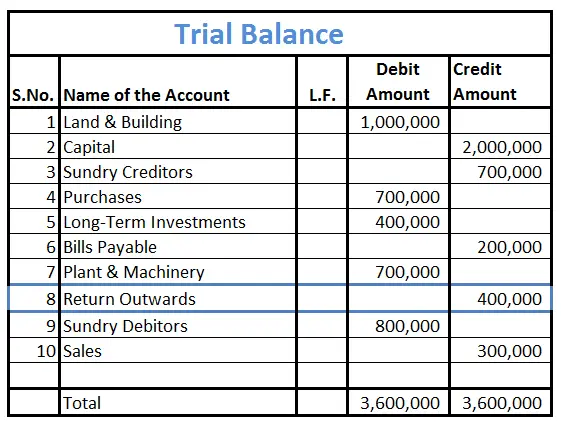

Carriage Outwards Carriage Inwards In Trial Balance Accounting Capital

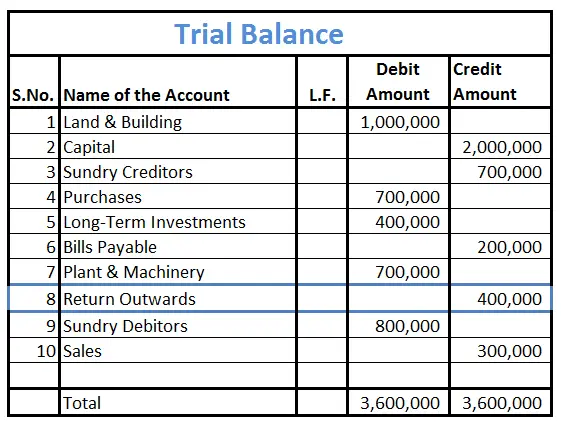

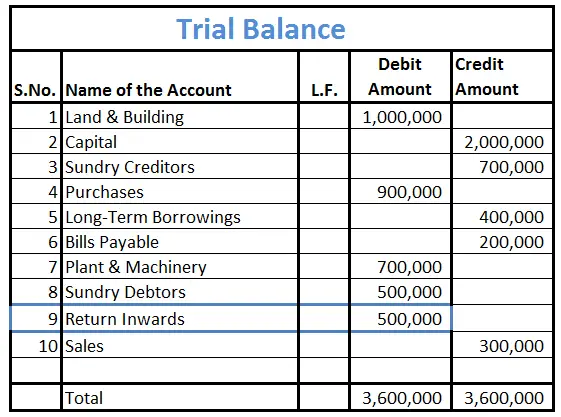

How Is Return Inwards Treated In Trial Balance Accounting Capital

How Is Return Inwards Treated In Trial Balance Accounting Capital

0 Comments